You might have misunderstood how to improve your credit score – and you don’t even know what you don’t know.

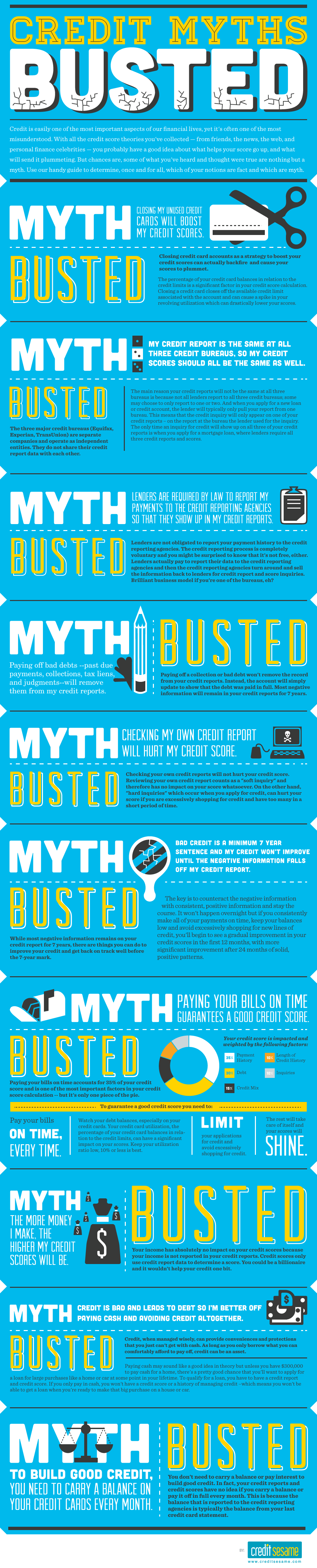

I just chanced upon this brilliant infographic by The Business Insider – 10 Credit Myths Busted. The words are rather small, but kudos to the information provided. I’ve heard of these credit misconceptions from many people, many times before. Personally, myths #4, #6, #7 and #9 are the ones that keep resurfacing.

So double check to make sure you haven’t fell for some of these myths. You don’t want to be doing the wrong things with your credit scores and finances your whole life!

If you thought that:

- Closing your unused credit cards will boost your credit scores

- If your credit score is the same at all credit bureaus, your credit scores should be the same as well

- Lenders are required by law to report your payments to credit reporting agencies so that they show up in your credit reports

- Paying off bad debts will remove them from your credit reports

- Checking your own credit report will hurt your credit score

- Bad credit is a minimum 7 years sentence and your credit won’t improve until the negative information gets removed from your credit report

- Paying your bills on time guarantees you a good credit score

- The higher your income, the higher your credit scores are

- Credit is bad and leads to debt, so you’re better off using cash and avoiding credit altogether

- You need to carry a balance on your credit cards every month to build good credit

Well, then check out this infographic.

To buff up your knowledge on credit scores, we’ve got a 2-Minute Guide to Credit Score in Singapore as well!

Bottom line: Don’t avoid credit completely – there’s so many perks to owning a credit card. Just be sure to pay your bills on time and avoid debts, as well as excessive shopping for credit.

Written by: Elaine Tay

Advertisement