In 2013, I redeemed two round-trip tickets from Singapore to Barcelona with my credit card air miles! Just this year in March, I redeemed another ticket to Tokyo (and I could have redeemed a pair of tickets if not for the fact that my husband was not free). Well, today I’m here to share with you 5 things you should know about your credit card air miles^ and along the way, I will dispense some gems to help you maximise your miles accrual.

It is a poorly kept secret that accumulation of air miles is one of the best reward programmes for credit card spend. I for one is a big fan of credit card air miles as I managed to chalk up many air miles courtesy of my expensive wedding and renovation payments. But it was also my experience that made me savvier, hence I hope this post helps you! Read on for some tips to bring you closer to your holiday destination.

^In this post, we will be referring predominantly to Kris Flyer Air Miles as most of the credit cards in Singapore have a rewards programme for it (as compared to Asia Miles which have lesser rewards programmes)

1. Air Miles gives you better bang for your buck than other rewards

If you are clueless as to why most people use their credit cards to accumulate air miles, this is because miles accrual is more valuable than exchanging your credit card points for vouchers.

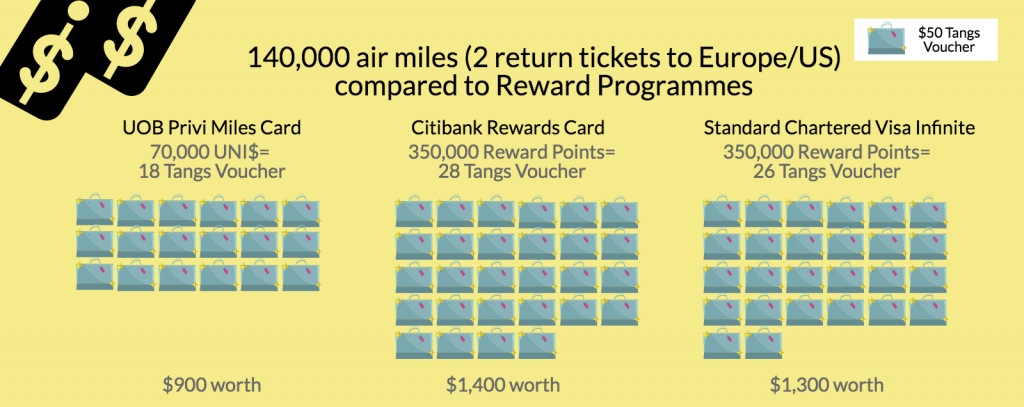

A pair of return tickets from Singapore to United States/ Europe costs 140,000 air miles (do note that you will still have to pay for carrier surcharges and airport tax). In my case, a SQ economy class ticket to Barcelona usually costs about $2,200 (and a pair of tickets would set you back $4,400). For my pair of round-trip tickets (SIN-BCN) I only paid about $1,000 for the carrier surcharges and airport tax which means my air miles are worth more than $3,000.

To help you better compare the value of the rewards*,140,000 air miles is equivalent to:

Air miles vs reward points

*Tangs Voucher used for the purpose of comparison

You lose more than half the amount you would have received if you choose to redeem shopping vouchers over air miles. Are you now convinced to start chalking up air miles?

But wait, what about cashback programmes?

I have many lazy busy friends who prefer cashback programmes.

Krisflyer air miles expire after 3 years hence let us compare cashback and air miles over a period of 3 years. Let us take a quick look at the Manhattan World Mastercard’s cashback programme- you get 3% cashback if you spend more than $3,000. However each quarter is capped at $200 cashback (maximum cashback of $800 a year); this means you get $800 back for spending above $12,000 in a year. In 3 years, you can get $2,400 cashback for spending above $36,000.

If you compare this to air miles from credit cards, let’s refer to a credit card like Citibank Premier Miles card; $36,000 would translate to 43,200 air miles which can get you one return ticket from Singapore to Perth. A quick check online show that a Singapore Airlines return ticket from Singapore to Perth costs between $750 to $1,100. This means we get more value from cashback programmes. So why use air miles credit cards?

Cashback programmes are great, but due to the fact that they cap your cashback amount, if you are spending on big ticket items over a short span of time, it would make more sense to use the air miles credit cards. In short, if you are renovating your house or spending on your wedding, take out the air miles credit card.

Does the Manhattan World Mastercard sounds like the easy way out? Apply for it here.

2. Redeeming your Air Miles online saves you 15% of miles.

Earlier we talked about how a pair of return tickets from Singapore to United States/ Europe costs costs 140,000 air miles. Well, here’s tip #2: Did you know that if you redeem your Krisflyer miles online (https://www.singaporeair.com/en_UK/ppsclub-krisflyer/miles/how-to-use/), it gives you a 15% discount and it only costs 119,000 air miles!

3. Free Lounge Access with your Credit Card

Most credit card with air miles provide complimentary lounge access. Whenever I have long transits I look forward to one of my free lounge access as I know I will have Internet, hot food and drinks (free alcohol!), comfortable seats and a quiet corner to wait for my flight. Some lounges even have showers and spa services (chargeable).

Credits cards that provide free lounge access are: Citibank Premier Miles Card, Standard Chartered Visa Infinite Card, ANZ Travel Visa Signature and Maybank Horizon Visa Signature.

Maximising Credit Cards for Airport Lounge Access Yearly

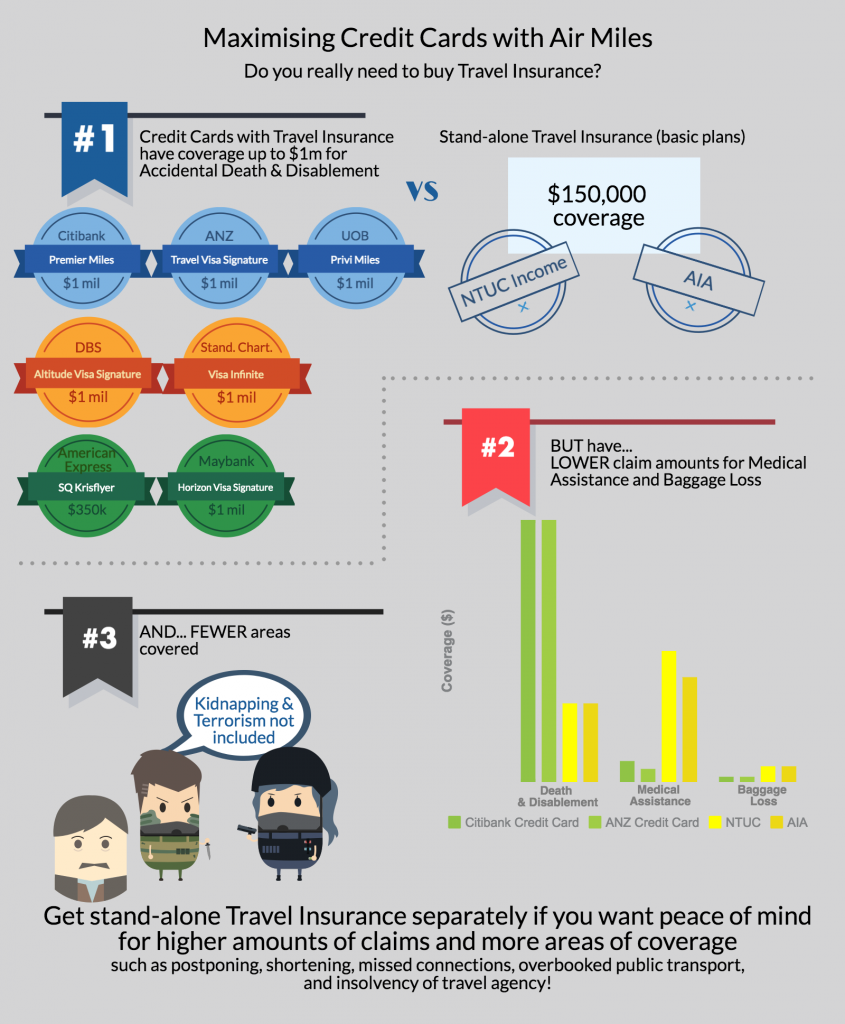

4. Free Travel Insurance

When you charge your air tickets to your credit card, you are covered by the complimentary travel insurance that your credit card provides. If you only require very basic travel insurance, that coverage would probably be enough for you. Most of the cards listed below have travel and accident coverage of up to $1 million. Here’s a table comparing the travel insurance provided by 2 credit cards versus 2 insurance companies.

| Insurance | Citibank Credit Cards (includes Premier Miles and Rewards Card)- by AIG | ANZ Travel Visa Signature- by AIG | NTUC Income Classic Travel Insurance | AIA Around the World Plus Classic |

| Accidental Death & Permanent Disablement | Cardmember: 1,000,000 Spouse: 1,000,000 Child: 50,000 | Cardmember: 1,000,000 Spouse: 1,000,000 Child: 100,000 | Adult: 150,000 Child: 75,000 | Adult: 150,000 Child: 50,000 |

| Medical Assistance | Cardmember: 40,000 Spouse: 40,000 Child: 20,000 | Up to 25,000 (Covers spouse and child) | Adult: 250,000 Child: 150,000 | Adult: 200,000 Child: 200,000 |

| Emergency Medical Evacuation | Cardmember: 100,000 Spouse: 100,000 Child: 100,000 | 100,000 (Covers spouse and child) | Adult: 500,000 Child: 500,000 | 500,000 |

| Repatriation | Cardmember: 50,000 Spouse: 50,000 Child: 50,000 | 10,000 (Covers spouse and child) | Adult: 50,000 Child: 50,000 | NA |

| Baggage Loss | Only for cardmembers- $1000 max | 1,000 (Covers spouse and child) | 3,000 | 3000 |

| Baggage Delay | Only for cardmembers- $500 max ($200 for every 8 hours of delay) | NA | 1,000 | 1,000 |

| Flight Delay | Only for cardmembers- $500 | 1,000 (Covers spouse and child) | 1,000 | 1,000 |

| Trip Cancellation | Only for cardmembers- $500 | 1,000 (Covers spouse and child) | 5,000 | 5,000 |

| Trip Interruption | Only for cardmembers- $500 | NA | 1,000 | 1,000 |

| References | http://www.citibank.com.sg/global_docs/pdf/travelins/AIG_Terms_and_Conditions.pdf http://www.income.com.sg/forms/brochure/travel.aspx?ext=.pdf | |||

Credit Cards with Travel Insurance

However while the coverage might seem higher, do note that the travel insurance under credit cards are very basic and you might not be able to make a claim depending on the fine print. For instance, some travel insurance policies under credit cards will not allow you to make a claim if you have a pre-existing health condition.

As you can see, buying your insurance directly from insurance companies provide higher coverage in most scenarios such as travel delays and baggage loss. It also provides for extensive coverage such as losing your money or travel documents, as well as postponing/ shortening/ missed connections/ overbooked public transport/ travel agency insolvency/ kidnapping/ terrorism. Hence it really depends on how extensive you want your insurance coverage to be while travelling.

Credits cards that provide free travel insurance are: Citibank Premier Miles Card, Citibank Rewards Card, ANZ Travel Visa Signature Card, UOB Privi Miles Card, DBS Altitude Visa Signature Card, Standard Chartered Visa Infinite Card, American Express Singapore Airlines Krisflyer Card and Maybank Horizon Visa Signature.

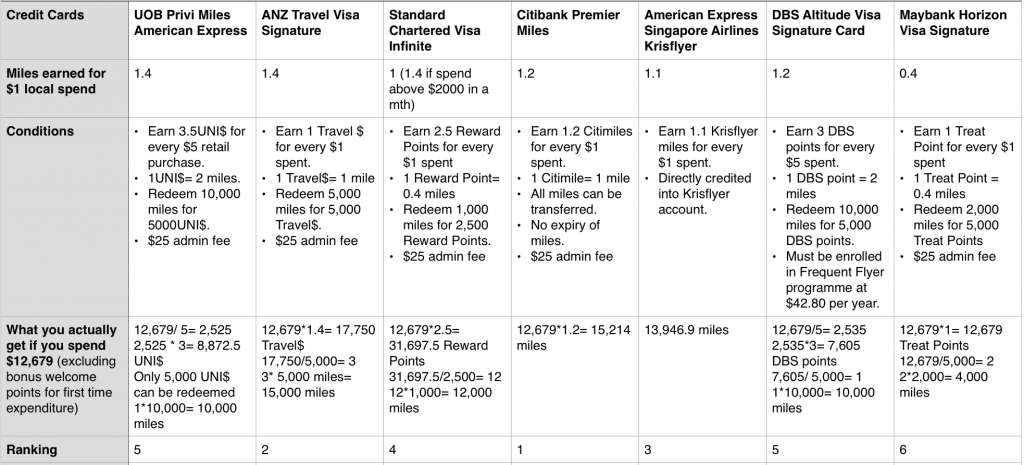

5. Do not believe everything you read about Air Miles in advertisements. Read the fine print.

There was a period in my life I was addicted to applying for the latest credit card that screamed “highest air miles accrual in town”. I am embarrassed now to say that I did apply to most banks, as such I am familiar with some of the more popular credit cards that are targeting frequent fliers. Till today I still see advertisements screaming in my face boasting that they give out the most air miles per dollar spent. But because I have firsthand experience, let me tell you something very important: “Read the fine print.”

If you do read the fine print, you will be shocked to realise that everything is not as it seems and that the “lowest miles per dollar” awards the most miles in the end. Most people do not realise that some credit cards only clock miles for local spend in multiples of 5. For instance, some award 3 points for every $5. On top of this, many credit card companies only allow you to convert your credit card points to air miles in fixed quantum of 5,000. The implication of this is that if in the scenario you have 14,000 credit card points, only 10,000 credit card points will be converted and you lose 4,000 credit card points until you accumulate enough for the next point of redemption.

What credit card did I stick with? Check it out yourself (hint: look for the one with the number one ranking)! Hopefully you will master the art of accumulating air miles with your credit cards!

Credit card Airmiles – read the fine print

Written by Lydia Lok

About the Writer: Lydia loves credit cards and air miles because they have brought her to Barcelona and Japan. As a result, she is passionate about educating friends and everyone else about how they can maximise their credit cards’ rewards. In her former life, she was a government servant who dealt with policies regarding social issues and businesses. Lydia is now a social entrepreneur involved in business development, and Children’s phonics and literacy. She lives in Singapore with a fluffy Sheltie named Lemon and a non-fluffy husband named Shuohan.

Advertisement