Editor’s Note: All content and information in this article are accurate as of published time.

Whether you own a SME, work for a MNC or manage any business, using a suitable business credit card could be an easy and practical way that can help earn some perks, save time on payments and might even result in some savings for your business over time. As a business owner or director, we know that you certainly have got lots on your plate. It ranges from managing business-related payments, tracking expenses or even employee expenses and spending – depending on your business requirement.

If you or your employees also travel for business regularly, there are also certain credit cards that are great for business travel. Compared to standard credit cards, travel business credit cards are helpful with travel-specific advantages like allowance of huge discounts on travel deals, no foreign transaction fees, and interest-free installment plans. With these benefits, you can maximise your spending abilities while travelling for work.

From cash rebates, cashback, dining discounts, airline deals and more, there are quite a few business credit cards available in Singapore with different perks, so which should you pick? Check out this guide to find the best business credit card suitable for you!

Here’s an overview of some of the best business cards in Singapore:

(Click on the respective card names to read more)

| Category | Credit Card | Best for… |

| BUSINESS SERVICES DISCOUNT | Aspire Corporate Card | Cashback on Online Marketing and Saas (Software as a service) + Low and transparent FX fees. (Note: This is a debit card) |

| Volopay Corporate Card | Cashback on FX transactions, no limitations on spend, accounting automation, real-time spend tracking | |

| DBS World Business Card | Discounts on selected business essential services, rewards for recurring bill payments | |

| UOB Platinum Business Card | Discounts on business essential services such as utilities and logistics, cash rebates + interest-free instalment plan | |

| BUSINESS CASHBACK | Citibank Corporate Card | Earn 0.3% cashback of the company’s annual spending when you put all your corporate expenses onto the card |

| Standard Chartered Business Platinum Card | Cashback + Reward points, 3-year fee waiver, 0% Interest instalment plan | |

| DBS Visa Platinum Business Card | High cashback rate at 0.4%, rewards for recurring bill payments | |

| BUSINESS TRAVEL | AMEX Singapore Airlines Business Card | Earn 8.5 HighFlyer Points per S$1 spend on eligible Singapore Airlines Group flights (worth 8.5% cashback); 1.8 HighFlyer points on other eligible spend (worth 1.8% cashback) Note: From 13 July 2021, American Express® Singapore Airlines Business Credit Cardmembers can convert 1 HighFlyer point to 1 KrisFlyer mile*. This offers twice the value for each HighFlyer point. Cardmembers will continue to earn HighFlyer points, while their employees will continue to earn KrisFlyer miles on their account when they fly with the Singapore Airlines Group (*T&Cs apply) |

| DBS Corporate Charge Card

| Up to 50% savings on travel, petrol and business benefits | |

| Maybank Business Platinum Card | Earn points for every dollar spent; points can be used to redeem KrisFlyer Miles and Asia Miles at attractive rates | |

| AMEX Corporate Gold Card | Travel with a peace of mind with AMEX Travel Services, Worldwide Customer Services, AMEX Emergency Global Assist® Hotline, Free Travel Insurance & more |

Best for Business Services Discount

1. Aspire Corporate Card ⭐

Here’s one corporate card that would stretch your dollar further than you think. The Aspire Corporate Card is a free virtual card that is linked to a digital Aspire Business Account. This is also one business debit card that offers up to 1% cashback on your company’s digital spend like online marketing & software subscriptions (SaaS), including Facebook, Google and LinkedIn advertising; Amazon Web Services, Google Suite, Mailchimp, Shopify, Salesforce, Xero and more!

Most importantly, you can save time, save money and gain access to over S$50,000 worth of exclusive benefits from Aspire’s platform partners! Find out more here.

Here are some of the best points to note about the Aspire Corporate Card:

| ✔️ | Cashback on digital spend: Up to 1% cashback on online marketing and Software-As-A-Service (SaaS). Cashback payouts will be made monthly in SGD, credited directly into your Aspire Account |

| ✔️ | Free Debit card: Tagged to your Aspire Business account, the Aspire Card is a free virtual card that can be added to your Apple & Google Wallets |

| ✔️ | Lowest FX rates: Low foreign transaction fees and low transparent rate |

| ✔️ | Real-time notifications: Receive real-time notifications on expenditure |

| ✔️ | PayNow: Incoming and outgoing PayNow payments available |

| ✔️ | No annual fees |

Combining the best FX rate in the market with no foreign transaction fees with the cashback on digital spend translates to major savings especially if yours is a digital business or have overseas expenditure in foreign currency. Best of all, the Aspire Corporate Card is completely FREE and you can apply online in just 5 minutes. With no annual fee or hidden charges, this fuss-free corporate card definitely comes in handy for every business, especially SMEs!

2. Volopay Corporate Card ⭐

The Volopay Corporate Card is a single business account that does it all for all your business expenditure – whether it is expense management, customisable spending rules, approval flows, credit lines to accounting automation. Volopay also offers both physical and virtual cards for your team. You’ll also get a personal account manager tagged to your account for 24/7 support.

The Volopay Corporate Card is a single business account that does it all for all your business expenditure – whether it is expense management, customisable spending rules, approval flows, credit lines to accounting automation. Volopay also offers both physical and virtual cards for your team. You’ll also get a personal account manager tagged to your account for 24/7 support.

Tap into Volopay’s flexible credit line of up to 500k on the cards. What’s more, Volopay also offers the highest cashback in the market currently with up to 2% cashback on all FX transactions, including online hosting, subscription and overseas spending. Find out more here!

Here are some of the best points to note about the Volopay Corporate Card:

| ✔️ | High cashback: Volopay offers the highest cashback of flat 2% on all FX transactions with no limitation on spend |

| ✔️ | Out-of-pocket reimbursement: With Volopay, your employees’ submission of invoices and refund claims are just a click away |

| ✔️ | Credit line up to S$500k: Credit line up to S$500k with extremely fast credit scoring process within 48 hours |

| ✔️ | Unlimited virtual cards: With Volopay, you can create unlimited virtual cards, (recurring or burner) to make online payments. Virtual cards are the safest way to pay online. |

| ✔️ | Budgeting with maker-checker: Volopay offers a seamless expense management software with budgeting and approval flow. |

| ✔️ | Accounting Automation: Syncs perfectly with most accounting software – so all your expenses sit into your accounting software with just a few checks and clicks, thus saving you a lot of working hours. |

Enjoy lifetime free access to the Volopay Corporate cards and services with no hidden charges. Learn more here.

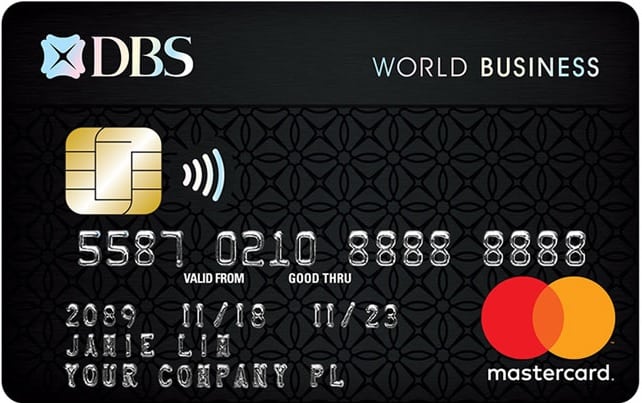

3. DBS World Business Card

With the DBS World Business Card, you’ll get to enjoy a world of benefits for your business from fuel discounts, dining, cash rebate on online spend as well as exclusive privileges from the Visa Commercial Offers programme. If you need to make frequent business trips, this card also provides up to 2% cash rebate for your overseas spending, as well as 10 complimentary priority pass per annum to over 1,000 airport lounges worldwide. Find out more here.

With the DBS World Business Card, you’ll get to enjoy a world of benefits for your business from fuel discounts, dining, cash rebate on online spend as well as exclusive privileges from the Visa Commercial Offers programme. If you need to make frequent business trips, this card also provides up to 2% cash rebate for your overseas spending, as well as 10 complimentary priority pass per annum to over 1,000 airport lounges worldwide. Find out more here.

Here are some of the best points to note about the DBS World Business Card:

| ✔️ | Cash rebates in DBS rewards points: Redeem DBS reward points for cash rebates, shopping vouchers or air miles |

| ✔️ | Mastercard Easy Savings: Earn automatic cash rebates on your business expenses at participating merchants such as Samsung, Symantec, Microsoft, Apple, SF & more |

| ✔️ | Travel accident insurance coverage: Up to S$1 million travel insurance coverage when the full travel fare is charged to your DBS World Business Card |

| ✔️ | Up to US$1.65 million employee misuse coverage: Get complimentary coverage of up to US$25,000 per cardholder and US$1.65 million per company, when you sign up for two or more cards |

| ✔️ | Recurring bill payment: Enjoy the convenience of paying monthly utilities, telephone and town council bills with DBS Recurring Bill Payment. |

There is a 1-year annual free waiver for the DBS World Business Card, afterwhich there is an annual fee of S$406.60.

4. UOB Platinum Business Card

If optimising your company’s cashflow and being in control of your business expenses sounds good to you, here’s why the UOB Platinum Business Card would be ideal for you. With this card, not only do you get to enjoy financial flexibility with the UOB Commercial Privileges Programme that gives you access to preferential rates and exclusive discounts from UOB’s participating partners, you can also earn automatic cash rebates.

If optimising your company’s cashflow and being in control of your business expenses sounds good to you, here’s why the UOB Platinum Business Card would be ideal for you. With this card, not only do you get to enjoy financial flexibility with the UOB Commercial Privileges Programme that gives you access to preferential rates and exclusive discounts from UOB’s participating partners, you can also earn automatic cash rebates.

Here are some of the best points to note about the UOB Platinum Business Card:

| ✔️ | Choice of cash rebate or UNI$: 0.3% cash rebate or UNI$1 for every S$5 charged on monthly purchases. |

| ✔️ | Mastercard Easy Savings: Earn automatic cash rebates on your business expenses at participating merchants such as Apple, United Airlines and SF Express. |

| ✔️ | Travel accident insurance coverage: Complimentary coverage up to S$1,000,000 for Travel & Personal Accident and other travel inconveniences when the full travel fare is charged to UOB Platinum Business Card. |

| ✔️ | UOB Commercial Privileges Programme: Gives you access to exclusive discounts and privileges from reputed suppliers. |

| ✔️ | Improved cash flow: Enjoy extended payment terms of up to 51 days. |

The annual fee for the UOB Platinum Business Card is S$180. Learn more about the card here.

Best for Business Cashback

5. Citi Corporate Card ⭐

Be rewarded with 0.3% cashback of the company’s annual spending when you put all your corporate expenses onto the Citi Corporate Card. This cashback bonus results to major savings especially if you have heavy expenditures during business trips.This single payment solution in the form of a Citibank Corporate Card is useful for all business needs and can help streamline expenses, especially for small businesses.

Be rewarded with 0.3% cashback of the company’s annual spending when you put all your corporate expenses onto the Citi Corporate Card. This cashback bonus results to major savings especially if you have heavy expenditures during business trips.This single payment solution in the form of a Citibank Corporate Card is useful for all business needs and can help streamline expenses, especially for small businesses.

Here are some of the best points to note about the Citi Corporate Card:

| ✔️ | Single Payment Solution: Save time and resources on painful manual express processing with this simple and single payment solution that allows you to reconcile and track expenditure easily. |

| ✔️ | Be rewarded with Citi ThankYou Points: Earn 0.3% cashback of the company’s annual spending when you put all your corporate expenses onto the card (Different suite of liability types available) |

| ✔️ | Travel accident insurance coverage: Complimentary travel accident insurance coverage of up to S$1,000,000 per cardmember when full fare is charged to the Citi Corporate Card. |

| ✔️ | Quick & hassle-free contactless payment: For Personal Liability Corporate Cardmembers, you can enjoy quick and hassle-free payment for transactions below S$100 at participating Visa payWave merchants with the contactless Visa payWave feature in your card. |

| ✔️ | Globally recognised and accepted: Pay for all your travel, entertainment and other business expenses at over 33 million establishments worldwide. |

To apply, the minimum net worth of a company starts at S$50,000 depending on years of operation. The annual fee for the Citi Corporate Card is S$150. Learn more about the card here.

6. Standard Chartered Business Platinum Card

If you’re a businessman that is frequently on the go, you’ll definitely want to experience the extraordinary benefits of the Standard Chartered Business Platinum Card that allows you to enjoy 24-hour Visa Platinum Concierge to help provide you any travel assistance, reservations or gift services whenever you need them. Such convenience will definitely allow you to focus on what you do best – your business!

If you’re a businessman that is frequently on the go, you’ll definitely want to experience the extraordinary benefits of the Standard Chartered Business Platinum Card that allows you to enjoy 24-hour Visa Platinum Concierge to help provide you any travel assistance, reservations or gift services whenever you need them. Such convenience will definitely allow you to focus on what you do best – your business!

Here are some of the best points to note about the StanChart Business Platinum Card:

| ✔️ | Earn Reward Points: Earn 1 point for every S$1 charged to your card, which can be redeemed for rewards of your choice. |

| ✔️ | 24-hour Visa Platinum Concierge: StanChart’s concierge and customer service are on hand 24/7 to provide travel assistance, reservations and shopping and gift services to save you time. |

| ✔️ | StanChart Easy Bill: Earn cashback/reward points/bonus interest on IRAS, education, insurance and even rental payment |

| ✔️ | 0% Interest Instalment Plan: Manage your finances with StanChart’s interest-free monthly instament plans |

| ✔️ | CardSafe Guarantee: Protect yourself from unauthorised transactions when you shop online |

There is a 3-year annual free waiver for the Standard Chartered Business Platinum Card, afterwhich there is an annual fee of S$150.

7. DBS Visa Platinum Business Card

Tap into a host of benefits that comes with a DBS Visa Platinum Business Card. From improving your business cash flow, consolidating bill payments into a single credit card statement, earn points for vouchers, air miles or cash rebate, this card allows you to free up your time and resources to concentrate on growing your business. Learn more here.

Tap into a host of benefits that comes with a DBS Visa Platinum Business Card. From improving your business cash flow, consolidating bill payments into a single credit card statement, earn points for vouchers, air miles or cash rebate, this card allows you to free up your time and resources to concentrate on growing your business. Learn more here.

Here are some of the best points to note about the DBS Visa Platinum Business Card:

| ✔️ | Earn Reward Points: Earn 1 DBS point for every $5 charged and redeem points for vouchers, air miles or 0.4% cash rebate |

| ✔️ | Improve cash flow: Pay suppliers on time while extending credit terms up to 55 days at 0% financing cost. |

| ✔️ | Complimentary travel accident insurance: Up to S$1 million per cardholder when the full airfare is charged to the card |

| ✔️ | Complimentary annual coverage of employee misuse: Up to US$ 25,000 per cardholder and US$ 1.65 million per company |

| ✔️ | Recurring bill payments: Consolidate bill payments to various suppliers into a single credit card statement |

There is a 1-year annual free waiver for the DBS Visa Platinum Business Card, afterwhich there is an annual fee of S$180.

Best for Business Travel

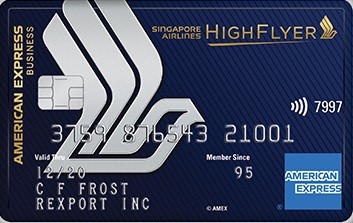

8. AMEX Singapore Airlines Business Credit Card ⭐

Double your rewards with the American Express Singapore Airlines Business Credit Card that incorporates the Singapore Airlines HighFlyer corporate travel programme. Perfect for small and medium-sized businesses, this means that you get to earn double rewards for flying with the Singapore Airlines Group – Your business earns HighFlyer points on the company account while your employees get earn KrisFlyer miles on their personal accounts! Learn more here.

Double your rewards with the American Express Singapore Airlines Business Credit Card that incorporates the Singapore Airlines HighFlyer corporate travel programme. Perfect for small and medium-sized businesses, this means that you get to earn double rewards for flying with the Singapore Airlines Group – Your business earns HighFlyer points on the company account while your employees get earn KrisFlyer miles on their personal accounts! Learn more here.

Here are some of the best points to note about the AMEX Singapore Airlines Business Credit Card:

| ✔️ | Reward Points: Earn up to 8.5 HighFlyer Points per S$1 spend on eligible Singapore Airlines Group flights (worth 8.5% cashback); 1.8 HighFlyer points on other eligible spend (worth 1.8% cashback). HighFlyer points are valid for 3 years. |

| ✔️ | Complimentary travel accident insurance |

| ✔️ | Travel in style: Complimentary night’s stay every year, and up to 50% dining discounts with Accor Plus across Asia-Pacific |

| ✔️ | Interest-free credit: Enjoy up to 51 days interest-free from transaction date and 21 days from statement date on all purchases |

| ✔️ | Annual fee waived for a limited time |

To apply, the applicant should be a business owner and/or person with executive authority of a Company/Business with a Valid UEN.

The annual card fee is at S$299, but for a limited time only, the annual fee is waived.

9. DBS Corporate Charge Card ⭐

With a DBS Corporate Charge Card, you’ll get to enjoy discounts with DBS’ Commercial Card business privileges on travel, petrol and other business benefits – this is a great card to have if your business requires frequent business overseas travels. The DBS Corporate Charge Card can also be customised to suit your company’s reporting system, resulting in the streamlining of processing cost. Learn more here.

Here are some of the best points to note about the DBS Corporate Charge Card:

| ✔️ | Travel accident insurance coverage: Complimentary coverage up to S$1,000,000 per cardholder when full airfare is charged to the card. |

| ✔️ | Corporate liability insurance: Complimentary with an annual coverage of employee misuse of up to US$25,000 per cardholder and US$1.65 million per company (if your company holds two or more DBSPurchasing Cards). |

| ✔️ | Reporting: Access to DBS’ 24/7 online reporting tool for easy tracking, control and planning of your employees’ card expenditure. |

| ✔️ | Option to choose between Mastercard or Visa Corporate Card. |

| ✔️ | No annual fee! |

To apply, do note the typical requirements for DBS card applications. You’ll need to present valid proof that you meet the minimum income requirement of S$30,000 for Singaporeans and S$45,000 for non-Singaporeans.

10. Maybank Business Platinum Card

As a Maybank Business Platinum Cardholder, earn TREATS Points for every dollar spent, including utility bills! This reward, if accumulated, is redeemable for items from a wide variety of categories such as KrisFlyer Miles, Asia Miles, vouchers, cash credits and more. If you go on frequent business trips, you’ll be happy to know that this credit card rewards overseas spending with a glorious amount of reward points! Learn more here.

Here are some of the best points to note about the Maybank Business Platinum Card:

| ✔️ | Reward Points: Earn TREATS Points for every S$1 spent. Points can be used to redeem KrisFlyer Miles and Asia Miles at attractive rates and more. |

| ✔️ | Travel accident insurance coverage: Complimentary travel insurance available when air tickets or travel packages are charged in full to the card, which includes up to S$1,000,000 travel accident insurance and even up to S$1,000 luggage loss claims for both cardmember and family. |

| ✔️ | Interest-free credit: Enjoy up to 51 days of interest-free credit on purchases. |

| ✔️ | Reporting: Consolidated statements on expenses charged to all company-issued Maybank Business Platinum Cards are available for efficient tax reporting. |

| ✔️ | Flexible credit limits based on the company’s profitability and are unaffected by personal card limits. You can make business purchases and pay bills with ease with the additional working capital. |

There is a 2-year annual free waiver for the Maybank Business Platinum Card, afterwhich there is an annual fee of S$180.

To apply, please note that your company must be registered with ACRA Singapore, with at least one local Director (Singapore citizen or Singapore PR) as well as in operation for at least two years with an annual sales turnover of at least S$200,000.

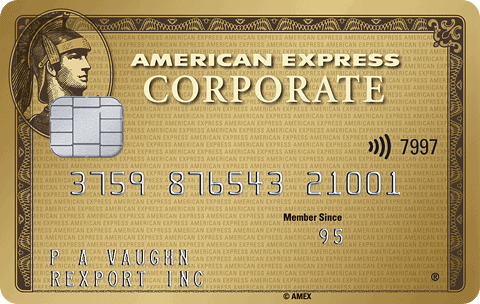

11. AMEX Corporate Gold Card ⭐

With the American Express Corporate Gold Card, your company can enroll in the AMEX Corporate Membership Rewards programme. For multiple cardholders, this is beneficial because you can charge ALL business-related expenses to a single card. This means, your rate of accumulating points becomes much higher – and you can redeem these points even quicker! Learn more here.

With the American Express Corporate Gold Card, your company can enroll in the AMEX Corporate Membership Rewards programme. For multiple cardholders, this is beneficial because you can charge ALL business-related expenses to a single card. This means, your rate of accumulating points becomes much higher – and you can redeem these points even quicker! Learn more here.

Here are some of the best points to note about the AMEX Corporate Gold Card:

| ✔️ | Reward Points: The American Express Corporate Membership Rewards® programme enables your company to earn 1 point for every S$1.60 you spend on all company expenses and redeem for a variety of rewards. |

| ✔️ | Travel accident insurance coverage: Up to S$1,000,000 business travel accident insurance while travelling on business trips booked using the card |

| ✔️ | AMEX Travel Services: Travel with a peace of mind with assured reservations, Worldwide Customer Care Services to see to flight rescheduling, rental reservations and more. |

| ✔️ | AMEX Emergency Global Assist® Hotline: Get help with any legal and medical emergencies during business travel. |

| ✔️ | Combined liability option: This allows your company to be liable only for business charges, while your employee is responsible for their personal charges. |

You can also choose from a variety of billing and payment options to sync with your company’s accounting systems and schedules, as well as to track and manage payments with individual or central billing.

The annual card fee is at S$180 so take note of this when you are renewing your card yearly.

Conclusion

With the convenience that these business cards offer, one important bonus is the complimentary travel insurance. We know that in every business, time and safety is crucial. Especially in an unexpected event of medical emergencies, baggage and flight delays, travel accidents and travel inconvenience during business travels, it is especially important that you and your staff can receive speedy help and compensation.

With all these privileges and benefits, applying for a suitable business credit card for your company is a smart move and can definitely help every dollar go a long way!

After you have learned about these travel business credit cards, which one catches your attention? Which one is worth applying for? Share your thoughts with us in the comments below!