Online expenditure in Singapore has grown with the increased accessibility and convenience of e-commerce in recent years. Statistics has alsoshown that Singaporeans make the most cross-border purchases online as compared to our Asia-Pacific neighbours.

In short, we LOVE to shop online! Some would even call it as their favourite pastime, which is why it is so important for online shoppers like ourselves to have a credit card designed for online shopping so we can save while we’re spending!

We’ve done some research and we’ve finally narrowed it down to 5 online shopping credit cards in Singapore with perks and features geared towards online shopping. Be prepared to enjoy some serious savings with cashback, rebates, earn miles, or even get exclusive discounts for selected merchants.

Ready to explore what these credit cards have to offer?

| Credit Card | Shopping Rewards |

| HSBC Revolution Card | 10X rewards points |

| OCBC Titanium Rewards Card | 10X rewards points |

| Standard Chartered Spree Credit Card | 3% cashback for foreign spend online, and 2% for local spend |

| Citi Rewards Card | 10X rewards points |

1. No Annual Credit Card Fee: HSBC Revolution Card

Save the hassle on remembering to pay for your annual credit card, as you can now own a HSBC Revolution Card with no annual credit card fee!

Earn 10X rewards points for every S$1 you spend when you shop online, order food delivery or make future travel bookings. You’ll also earn 10X rewards points when you make payments through Visa payWave, ApplePay and GooglePay. Not only that, be prepared to enjoy special offers with selected online merchants with this card.

Are you a first-time applicant? HSBC has a pretty amazing welcome offer of up to SGD200 cashback. If you refer a friend, you’ll be eligible to get up to S$250 worth of cash rebate when your friend or family signs up for the HSBC Revolution card.

Your Rewards points can also be translated into free flights with frequent flyer programmes from Singapore Airlines Krisflyer and Asia Miles. Every 25,000 Rewards points can be exchanged for 10,000 miles. If you’re interested in other items to redeem, HSBC’s rewards programme includes home, shopping, travel, dining and leisure treats.

| HSBC HSBC Revolution Credit Card |

Eligibility and Annual Fee of HSBC Revolution Card

- At least 21 years of age

- Minimum annual income of S$30,000 for Singaporeans and Permanent Residents

- Minimum annual income of S$40,000 for self-employed and foreigners

- Minimum Fixed Deposit Collateral of S$10,000 is required if you do not meet the income requirements

Pros

- 10X rewards points for online transactions, food delivery and travel bookings

- No minimum spend required

- Attractive welcome offer when you apply for the card

- No annual credit card fee

Cons

- Cap of 10,000 rewards point earn per statement month

- Limited options on items in the HSBC rewards programme catalogue

2. Best Card for Rewards: OCBC Titanium Rewards Card

The OCBC Titanium Rewards Card lets cardholders earn 50 OCBC$ for every S$5 spent (capped at 120,000 OCBC$ within one year starting from the month in which your card was issued) on eligible online and retail purchases. What’s more, the OCBC Titanium Rewards Card also comes with e-Commerce Protection which ensures your best online deals are being transacted securely. Now this is truly a shopper’s dream card.

The only catch is that there is a yearly cap of 120,000 rewards points you can earn. The consolation from this is that it is not as restrictive as a monthly cap, having 12 months to balance out the rewards points you can earn and enjoy.

3Eligibility and Annual Fee of OCBC Titanium Rewards Card

- At least 21 years of age

- Minimum annual income of S$30,000 for Singaporeans and Permanent Residents

- Minimum annual income of S$45,000 for foreigners

- S$192.60 annual fee (1st 2 years waived)

Pros

- 50 OCBC$ on eligible online & retail purchase

- No minimum spend

- 2 years annual fee waiver

- e-Commerce protection which safeguards you from non-delivery or defective goods if the seller fails to reimburse you. Coverage is up to US$200 per year

Cons

- Limit of 120,000 rewards points can be earned yearly

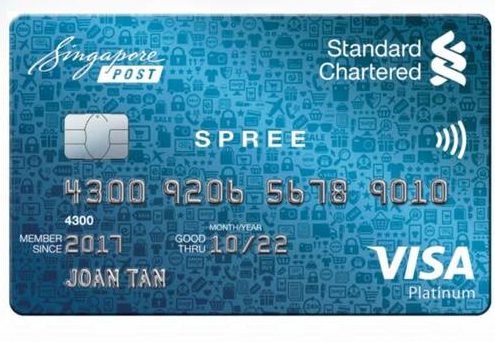

3. Best Card for Cashback with no minimum spend: Standard Chartered Spree Card Card

Standard Chartered’s Spree Credit Card gives 3% cashback on all vPost spend and online eligible purchases in foreign currency. This includes travel related expenses such as accommodation and air tickets – Good news for those who are frequent travellers! You’ll also earn 2% cashback for all online spend in local currency, all contactless and mobile payments.

There is also no mandated minimum spend amount required before you can start earning cashback which means, even if you only make one purchase this month, you’ll still be earning some cash for the amount you’ve spent. However, do note that the cashback amount is capped at S$60 per card account per month.

On top of that, Standard Chartered Spree Card allows you to enjoy up to 20% savings on your monthly fuel spending at Caltex. You will also get to enjoy exclusive privileges with with Lock+Store, smartpac and Singapore Post.

Another good point is that this c3% cashbard now has a 25% discount off shipping fees with vPost from now till 31 October 2021, so you can ship your overseas purchases at a lower fee.

| Standard Chartered Spree Credit Card |

Eligibility and Annual Fee of Standard Chartered SingPost Platinum Visa Card

- At least 21 years of age

- Minimum annual income of S$30,000 for Singaporeans and Permanent Residents

- Minimum annual income of S$60,000 for foreigners

- S$192.60 annual fee (1st 2 years waived)

Pros

- No min. spend

- 3% cashback on online spend in foreign currency

- 2% cashback for supermarket purchases

- Discounts with vPost

- 2 years annual fee waiver

Cons

- Cashback amount capped at S$60 monthly

- 1% cashback for all other retail transactions

4. Best Rewards Programme Card: Citi Rewards Card

In my opinion, the Citi Rewards Programme has one of the most extensive selection of gifts and vouchers to be redeemed. Therefore, signing up for a Citi Rewards Card is your first step to a wide range of gifts you can earn by charging your shopping expenses to your Citi Rewards Card.

This card allows cardholders to earn 10X rewards points for every S$1 spent online and retail when you shop for clothes, bags and shoes. You’ll also get to earn 10X rewards points on online food delivery, online groceries and also on rides with Grab, Gojek & more. What’s more, when you charge your airfare to Citi Rewards Card, you’ll also get to enjoy complimentary travel insurance.

One of the best selling points of the credit card is its flexible redemption of rewards through Citi ThankYou Rewards, where you can pay for any purchase with the points you’ve earned! That’s total control and maximum freedom in how you choose to spend your hard earned Citi Points!

From April 2019, you can also earn miles/reward points (depending on card type) when you pay your tax, rent, condominium management fee, school fee or electricity bill with Citi PayAll on the Citi Mobile® App.

| Citi Citi Rewards Card |

Eligibility and Annual Fee of Citi Rewards Card

- At least 21 years of age

- Minimum annual income of S$30,000 for Singaporeans and Permanent Residents

- Minimum annual income of S$42,000 for foreigners

- S$192.60 annual fee (1st year waived)

Pros

- Attractive rewards in rewards programme

- 10X rewards points valid for purchases of shoes, clothes or bags in physical stores (Local and Overseas)

- 10X rewards points also valid at department stores in Singapore

- 10X rewards points for online food delivery & groceries

Cons

- Only 1X reward points for all other spend that is not retail

- Cap of 10,000 rewards points per month

- Only 1 year annual fee waiver

A core benefit of online shopping is convenience, shopping at the tip of your fingers at the comfort of home. Shopping has been made easier and more accessible with the increased speed of technology. With the wide range of available items online, getting out of your house to shop is no longer mandatory. Many things, from apparels and accessories, to daily necessities and groceries, can now be purchased with a few clicks of your finger.

Perhaps you don’t regard yourself as an online shopper, but do you make frequent purchases online for yourself, your spouse or your family? Since these credit cards for online shopping allow you to get some discounts, whether they be in the form of rewards points, miles or cash rebates, why not make full use of them? Choose the most suitable card for your spending habit and the type of purchases you usually make, and apply for them today.

Ever wondered which banks’ credit cards give you the most perks? Check out the Best Credit Cards Perks & Rewards Comparison in Singapore based on actual promotion numbers here!

Advertisement