Are you a couple who is about to receive your HDB flat keys? Are you in the midst of planning for your wedding banquet? If so, read on! Today I am here with a cheat sheet on how you can get 2 return Air Tickets from Singapore to Europe in 7 easy steps. All in a span of one year with your credit card air miles!

I must admit that I am someone who loves credit card reward programmes! Growing up, I was always fascinated by news of how much a person can save by being very eagle-eyed with reward programmes. When I read about a mother who saved $40,000 (in Singapore dollars) in two years through cutting down her weekly grocery shopping expenditure from $300 to $60 by strategising with coupons, I was very impressed. On another occasion, my mind was blown away when I read this article about a man earning 1.2 million miles with chocolate pudding coupons. This video was very impressive!

Unfortunately for me (or fortunately for Singapore’s economy), Singapore businesses are savvier and coupons consist of fine print which states exclusions. There are often clever causes which states that a coupon cannot be combined or that each customer is only limited to X amount of miles in a specific period. Singaporeans have this wonderful term given to them (really, out of endearment) which is “kiasu”. This literally means “scared to lose”. As a result of not wanting to miss out on a good deal, businesses are always one step ahead of possible scenarios where they might be financially exploited by their “kiasu” customers. Despite our restrictions and not-so-generous retail stores here, I’ve met people who have developed unique hobbies of chasing after “freebies” or “contests”. Singaporeans learn to make-do with what we have in Singapore!

Me? I love strategising how I can maximise my various credit cards’ rewards programmes. I do admit I get a knack out of reading the fine print and legal jargon. It’s the thrill of figuring out what people really mean and finding the “loophole” that makes me do what I do. Or maybe, I’m just “kiasu” and I hate missing a good deal.

The interesting thing is this- Singaporeans want the best of everything. We want to get as many benefits as possible, but we also want to do it in the most effective way possible. I was reading about how the coupon-lady has made it a habit to check the internet daily for coupon deals and how the pudding-miles-guy constantly updates himself on the best miles deals through reading strategies from blogs online. Singaporeans? They would never do that. We hate having to juggle with too many strategies just to get a good deal. We want it to be short and sweet.

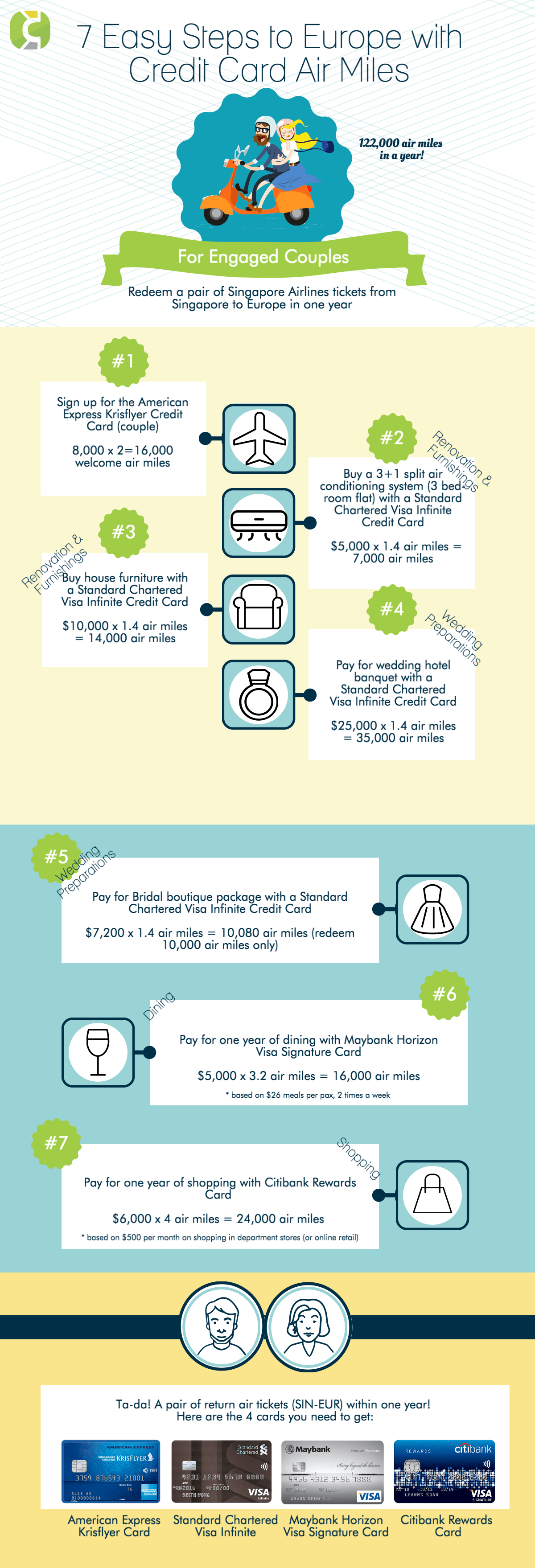

Hence today I have come up with 7 easy steps for you to earn enough air miles to redeem a pair of air tickets from Singapore to Europe. In one year! Hopefully it will help all you couples out there maximise your air miles in a short span of time.

Magic Formulae for a couple to get a return air ticket to Europe in 7 steps

Here is my magic formulae to redeem 2 return air tickets from Singapore to Europe in one year (119,000 miles for online redemption). This is based on the scenario of a couple using 4 credit cards- Standard Chartered Visa Infinite, American Express Krisflyer Credit Card, Maybank Horizon Visa Signature Card and Citibank Rewards Card.

- Both you and your significant other to sign up for the American Express Krisflyer Credit Card. Spend $700 in first 6 months to receive 5,000 air miles + 3,000 additional bonus air miles for spending $700:

8,000 * 2=16,000 welcome air miles from 2 applicationsRenovation and Furnishing (Look for retail shops that accept credit card payment)

- Purchase your 3+1 split air conditioning system for your 3 bedroom flat using the Standard Chartered Visa Infinite Credit Card:

$5,000* 1.4 air miles = 7,000 air miles - Purchase your house furniture using the Standard Chartered Visa Infinite Credit Card:

$10,000* 1.4 air miles = 14,000 air miles

Note: Examples of house furniture consists of sofa, bed, mattress, dining table, lights, fans etc. Remember to accumulate your purchase in a month. You will receive 1.4 air miles for every dollar spent when you have a total spend of more than $2,000 in a month.Wedding Banquet - Pay for your wedding hotel banquet using the Standard Chartered Visa Infinite Credit Card:

$25,000* 1.4 air miles = 35,000 air miles - Pay for your bridal boutique package using the Standard Chartered Visa Infinite Credit Card:

$7,200* 1.4 air miles = 10,080 air miles

Note: Technically, you will only earn 10,000 air miles with Standard Chartered’s Redemption policy.Calculation:

$7,200* 3.5 reward points= 25,200 reward points

Redeem 2,500 reward points for 1,000 air miles—> 25,200/ 2,500* 1,000 air miles= 10,000 air miles

Alternative suggestion: You will receive 4 air miles for every dollar spent by using the Citibank Rewards Card (bridal boutique should be a “retail store”)! Remember to check with your bridal boutique first about their credit card merchant code. Refer to point 7 below.Dating - Pay for your restaurant meals in this one year with Maybank Horizon Visa Signature Card:

$5,000* 3.2 air miles = 16,000 air miles

Note: Assuming a couple spends about $417 on dining out at restaurants in a month. If you meet twice a week and spend at least $26 each, this is quite a realistic figure. However, the bonus air miles received is dependent on the merchant code of the restaurant, and you have to spend at least $300 a month per card to be entitled to the bonus miles (in the credit card clause, ).Shopping - Pay for your shopping in this one year with Citibank Rewards Card: $6,000* 4 air miles = 24,000 air miles

Note: This is about $500 per month on shopping in department stores or online shopping. Again, this is dependent on their merchant code. This includes any department store worldwide or any retail store worldwide or shopping website that sells clothes, shoes and bags as its main business activity. There is a cap of $12,000 in a year for this reward programme.

Total: 122,000 air miles (taking into consideration the various credit cards’ redemption policy)

Infographic with these 7 Easy Steps for you to remember

To help you remember easily, here’s our infographic:

Ta-da! Your 2 return air tickets to Europe! I pretty much followed the formulae above. Except in my time (5 years ago), the Standard Chartered Visa Infinite was not in existence yet. Using mainly the Citibank Premier Miles Card instead which proved to be comparable as it offers 1.2 air miles vs Standard Chartered’s 1.4 air miles (and Citibank does not require a minimum of $2,000 spend a month), I supplemented my Citibank Premier Miles Card with American Express Krisflyer Credit Card, Maybank Horizon Visa Signature Card and Citibank Rewards Card).

The Fine Print

What are some of the key things to note in using this strategy?

Banks can be quite crafty when it comes to the fine print. They are not very forgiving in terms of the merchant code as they expect you to bear the responsibility for this. You would be heartbroken if you had strategised your spending, only to realise that you are not entitled to the bonus air miles as the merchant code or main business activity was different. It is also best to strategise for more air miles as you might lose some air miles in the conversion process for some credit cards. Do bear in mind that your spending amounts should be similar to what I listed above. We have talked about this in our previous article about Credit Card fine print.

PHEW! If you think that was a lot of effort for two return air tickets, you are lucky I did all the homework for you! Let me know in the comments below if you do try out my 7-step strategy! I would be terribly pleased to know that my hard work helped you to maximise your air miles!

Written by Lydia Lok

About the Writer: Lydia loves credit cards and air miles because they have brought her to Barcelona and Japan. As a result, she is passionate about educating friends and all about maximising their credit cards’ rewards. In her former life, she was a government servant who dealt with policies regarding social issues and businesses. Lydia is now a social entrepreneur involved in business development, and Children’s phonics and literacy. She lives in Singapore with a fluffy Sheltie named Lemon and a non-fluffy husband named Shuohan.

Advertisement