Ever find it scary having to pay for goods with your card in a transaction that reveals sensitive information about it? That, in the blink of an eye, everything you had worked for can vanish resulting from a theft given away by your card’s most sensitive information, much to your distress and trouble. Loaded or not, the amount of money or available credit which you have in your card is as valuable as the paper cash and coins you actually use when paying for goods at a real physical store.

Especially in today’s time and age where the card we previously held as a secure means of payment—that is, credit or debit card—is not really as safe as we thought, any aware individual would surely think twice before using their card, instead of cash, when making a truly secure payment, however old the notion may be.

Knowing the vulnerabilities in today’s credit/debit card designs, however, giant tech companies such as Apple, Samsung, and Google, developed their own version of an app that addresses today’s electronic payments most pressing issue: security of payment during any electronic transaction.

What Apple has Apple Pay and Samsung has Samsung Pay, Google has the so-called Android Pay, a kind of masked payment scheme that is, by current standards, a real secure means of paying electronically using one’s smart device.

How secure is an Android Pay payment?

Under the hood, Android Pay makes for an ideal payment method for its ability to exclude sensitive information about the card used in any transaction with it. It does so by a means of tokenization system which masks the payment details in a randomly-generated 16-digit number via NFC.

With no metadata being sent out, issues of data breach on the part of the company and NFC signal interception does not result to a loss of sensitive card information that may be used against your card.

This is in stark contrast to payment schemes where you are required to literally input sensitive data about your credit or debit card.

Using Android Pay in Singapore

Right now, there are only literally very few countries which support Android Pay. Outside of the US and the UK, Singapore makes for another country to implement Android Pay for consumers to use as a means of making a secure payment.

Android Pay, a rebrand of the not-so-successful Google Wallet, is a free service coming from the Google camp which tries to go toe-to-toe against rival companies’ own version of the same app.

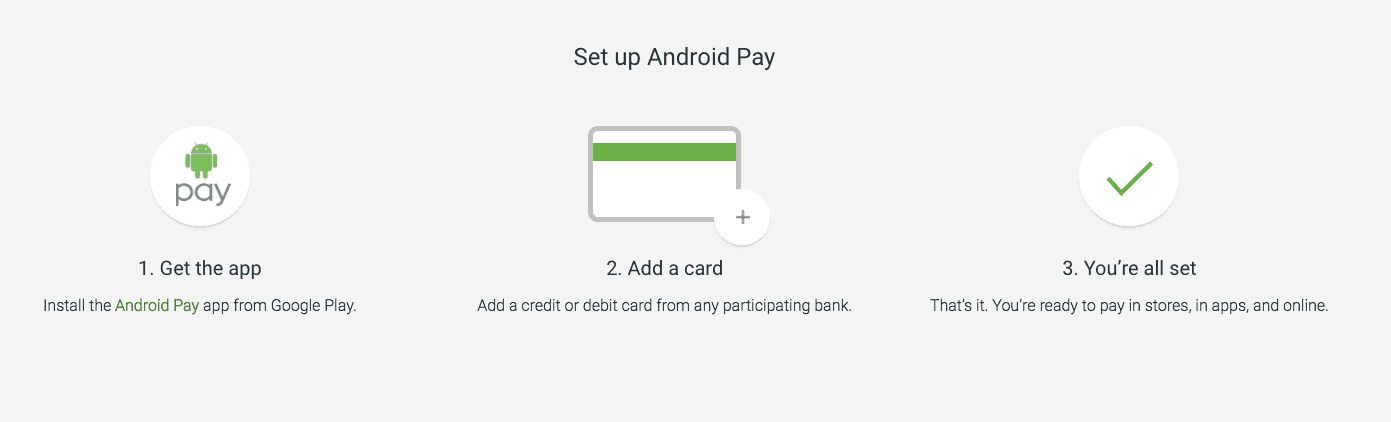

To use this service, you must first have to download it from the Google Play Store using an Android device running on Kit-Kat OS at least.

Once installed, simply run it and connect your credit or debit card (Visa or Mastercard from DBS, OCBC, POSB, Standard Chartered and UOB) which acts as the source of money for any payment.

Although the number of stores which support an Android Pay payment is relatively smaller than Samsung Pay or Apple Pay, paying with the app is as simple as going to the counter of the store you are buying from and having your device connect to a payment terminal while running Android Pay. (Click here for a tutorial on how to use Apple Pay in Singapore.)

Are you crazy about discounts, promotions and deals? Check out our Facebook page for latest credit card promotions and offers.

Advertisement